Since our investment activity began in 2011, we have been steadily growing our investment portfolio each year. By 2026, SCF will have made 49 unique investments into 19 organizations, totaling almost $12.9M in capital deployed. Of these investments, 79.5% were made into Certified CDFIs (90% if counting non-certified CDFIs). At year’s end, SCF’s total portfolio of 11 investments is worth almost $6 million.

Our Investment Partners

We’re proud to highlight our Investment Partners–comprised of mission-driven loan funds, banks/credit unions, investment funds and project developers–who truly create impact where it’s needed the most.

Atlanta Neighborhood Development Partners

Mission: To develop, finance, and advocate for affordable housing, promote racial equity, and create healthy communities where families can thrive, addressing the diminishing supply of affordable housing in the Atlanta area.

Partnership Status:

Active

Programs Funded:

(2024-2030)

- Affordable Housing Development Loans

BCL of Texas

Mission: To build strong communities in Texas by offering wealth-building assets for Texans through homeownership, entrepreneurship, financial literacy, and community development programs, focusing on under-resourced and low-income communities and individuals.

Partnership Status:

Active

Programs Funded:

(2018-2026)

- Diversity Fund

Blue Highway Capital

Mission: To generate attractive risk-adjusted returns for their investors by partnering with rural-based businesses to fuel sustainable growth, create quality jobs, and promote shared prosperity within their communities.

Partnership Status:

Active

Programs Funded:

(2018-2029)

- Blue Highway Growth Capital Fund

Business Consortium Fund

Mission: To expand capital access for small businesses across the United States to foster a more inclusive and equitable society.

Partnership Status:

Active

Programs Funded:

(2023-2029)

- Small Business Loan Fund

Fahe

Mission: To bring people, organizations, and resources together to build homes, communities, and a thriving Appalachia through expanding economic opportunity and security for all.

Partnership Status:

Active

Programs Funded:

(2019-2029)

- Community Loan Fund

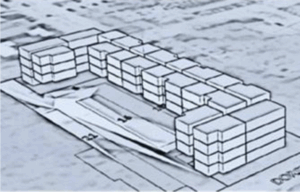

Fifty-Five Gorman

Project: Builds affordable housing for low-income families and commercial space for business in the Atlanta area.

Partnership Status:

Active

Programs Funded:

(2025-2026)

- Fifty-Five Apartments

Grameen America Inc.

Mission: To provide affordable micro-loans and financial services to low-income women entrepreneurs in the United States to help them build businesses and achieve financial mobility.

Partnership Status:

Active

Programs Funded:

(2017-2028)

- Grameen America Inc. Loan Fund

- Grameen America Social Business Fund

Lendistry

Mission: To provide economic opportunities and progressive growth for underserved urban and rural small business borrowers and their communities.

Partnership Status:

Active

Programs Funded:

(2022-2027)

- Small Business Loan Fund

LiftFund

Mission: To transform lives and strengthen communities by providing entrepreneurs and small businesses with resources and capital to help them build strong, sustainable businesses and achieve financial mobility.

Partnership Status:

Active

Programs Funded:

(2011-2030)

- National Disaster Business Recovery Loans

- Coastal Disaster Business Recovery Loans

- LiftUp Loan Program

- Promise Loan Program and more...

Northern Initiatives

Mission: To build stronger, more resilient communities by providing access to capital and resources for entrepreneurs and small business owners in Michigan, supporting job creation, economic mobility, and neighborhood revitalization.

Partnership Status:

Active

Programs Funded:

(2011-2030)

- Community Business Loan Fund #2

- New Markets Expansion Capital

- Community Business Loan Fund #1

Self Help Federal Credit Union

Mission: To create and protect ownership and economic opportunity for all by helping small and underutilized businesses grow and thrive.

Partnership Status:

Active

Programs Funded:

(2015-2026)

- General Loan Platform

- Racial Wealth Gap Initiative